This is Not 2008!

With housing prices on the rise over this past year, it is hard not to think about the housing crash in 2008. Today some are afraid that the real estate market is starting to look a lot like it did in 2006. I know we’ve talked about this in earlier posts but, I wanted to take a look around and see what the general feeling is out there.

Those of us who pay attention have seen the articles not only about historically low-interest rates but the availability of low-down-payment loans and down payment assistance programs. At a glance, these sightings, coupled with rises home prices, are causing some fear that we’re on that disastrous path we went down 15 years ago.

Here is the short version of the differences between what is going on now and what happened back then:

In both cases, low-interest rates played a role. Though the rates in 2006 would be high by today’s standards, they were low at that time. Both then and now, these low rates brought buyers to the table, pushing the demand side of the equation.

But this is where the similarities end.

Currently, more buyers are entering the market because they can afford more for less, but they are still qualified buyers. In 2006, that was not necessarily the case. The qualifications for obtaining a loan back then were much lower than they are now, and adjustable-rate mortgages (ARMs) were much more common. These mortgages made it affordable for many to get into their homes at a low-interest rate, but after (usually) a few years, they would then adjust up to the current rate of the time. The combination of these types of mortgages, coupled with minor or even no qualification requirements were a disaster waiting to happen.

Though the supply side of the equation impacted both periods, it did so for different reasons. In 2006, the housing inventory was flooded with buyers who were unqualified by today’s standards but had access to mortgages at the time. This drove home prices up, but many new homeowners were ultimately destined to default on their mortgages.

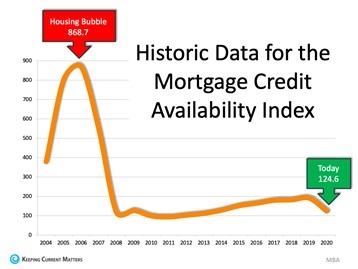

Just to put things in perspective: Several times a year, the Mortgage Bankers Association releases an index titled The Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is soley focused on mortgage credit. The MCAI is…a summary which indicates the availability of mortgage credit at a point in time.”

In other words, the index determines who easy it is to get a mortgage. The higher the index number, the more available (easy) mortgage credit becomes. As you can see in the graph below, the index number jumped from 400 in 2004 to 868.7 at the housing bubble height—comparatively, the current number is 124.6.

In today’s number, we can see that available credit is about 1/6 of what it was in 2006. As a result of the 2008 crash, today’s lending standards are much tighter. According to Investopedia, an American financial website founded during the dot com bubble, the types of risky loans granted back in 2006 are extremely rare today due to drastically improved standards.

Thankfully, lending standards have been relaxed somewhat since then. They are still high, as evidenced but average buyer credit scores. In 2006 mortgage entities originated $376 billion in loans to buyers with credit scores below 620. By comparison, that number was $74 billion in 2020. While there are still loan programs available to borrowers with sub 620 scores, lending institutions are much more attentive to risk in today’s market. According to Ellie Mae’s latest Origination Insight Report, the average FICO® score on all loans originated in February of this year was 753.

So, are we in a housing bubble? Maybe. But if we are, the reasons are different. Will we see the kind of market crash that we saw in 2008? The consensus seems to be it is not likely because that was the culmination of predatory lending that became a mortgage crisis, not a real estate crisis. Could home values decrease? Yes, because that is the nature of real estate, keeping in mind that the long-term trend has always been up.

So, one last swipe at the “equation,” if you will. The law of economics always measures value by supply vs. demand. Before the 2008 crash, home prices were driven up because the supply side was overwhelmed by demand from the flood of unqualified buyers that entered the market. This time we believe that while low-interest rates brought out buyers in force, there are just fewer homes to sell. In many cases, the seller’s primary concern is about where they go if they sell.

It is just early April, and the expectation is that more sellers will come off the sidelines in the coming months. This should ease some of the pressure, but it brings to mind an analogy.

For the past 25 years, Rebecca & I have been going to Rocky Mountain National Park in Colorado for hiking vacations. In recent years we have found that we need to get out extremely early in the morning just to get a parking spot at any of the trailheads. Not too long ago, an online article about RMNP said that seasonal visitation to the park had gone from 3 million visitors annually to over 6 million over the past decade. There are just more people.

Is the housing market going to crash? Well, not if the supply side has anything to say about it. It is reasonable to think that once the COVID mortgage forbearance ends, home prices will likely stabilize, but unless an overwhelming number of new homes hit the market quickly, a “crash” is unlikely.